Rumored Buzz on Kam Financial & Realty, Inc.

Table of Contents3 Easy Facts About Kam Financial & Realty, Inc. DescribedThe Greatest Guide To Kam Financial & Realty, Inc.3 Simple Techniques For Kam Financial & Realty, Inc.Everything about Kam Financial & Realty, Inc.Not known Details About Kam Financial & Realty, Inc. Unknown Facts About Kam Financial & Realty, Inc.

We might obtain a cost if you click a lender or send a kind on our internet site. This cost in no chance impacts the info or suggestions we give. We keep content self-reliance to guarantee that the referrals and understandings we offer are objective and unbiased. The lenders whose prices and other terms show up on this graph are ICBs promoting partners they give their price details to our information partner RateUpdatecom Unless readjusted by the customer marketers are sorted by APR most affordable to highest For any kind of advertising companions that do not offer their price they are listed in ad display systems at the end of the graph Marketing partners may not pay to improve the regularity priority or prestige of their display screen The rates of interest interest rate and other terms marketed right here are estimates offered by those marketing partners based upon the information you went into over and do not bind any type of lender Month-to-month payment quantities mentioned do not include quantities for tax obligations and insurance policy premiums The actual settlement responsibility will be greater if taxes and insurance are consisted of Although our information partner RateUpdatecom accumulates the info from the monetary institutions themselves the accuracy of the data can not be guaranteed Prices may change without notification and can transform intraday Some of the details had in the rate tables including but not limited to special advertising and marketing notes is provided straight by the lenders Please confirm the prices and deals prior to applying for a lending with the banks themselves No rate is binding up until locked by a lending institution.

Indicators on Kam Financial & Realty, Inc. You Need To Know

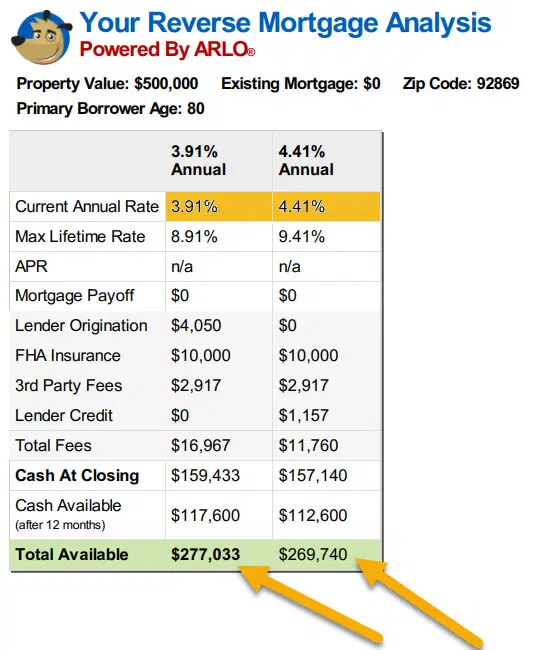

The amount of equity you can access with a reverse home loan is established by the age of the youngest borrower, current rate of interest, and the worth of the home in concern. Please keep in mind that you may require to allot added funds from the car loan proceeds to pay for tax obligations and insurance.

Rates of interest might vary and the stated price might alter or not be offered at the time of loan dedication. * The funds readily available to the consumer may be limited for the very first twelve month after car loan closing, due to HECM reverse home loan needs (https://kam-financial--realty-inc-47213321.hubspotpagebuilder.com/blog/your-expert-mortgage-loan-officer-california-kam-financial-realty-inc). In addition, the customer may require to set apart added funds from the lending continues to spend for tax obligations and insurance

A mortgage is basically an economic arrangement that permits a consumer to acquire a home by obtaining funds from a lending institution, such as a financial institution or monetary organization. In return, the lender puts a realty lien on the property as security for the loan. The home mortgage deal normally involves 2 primary papers: a promissory note and a deed of trust fund.

The Of Kam Financial & Realty, Inc.

A lien is a lawful insurance claim or rate of interest that a lending institution has on a debtor's home as safety and security for a financial obligation. In the context of a home loan, the lien created by the action of trust fund permits the loan provider to seize the building and sell it if the consumer defaults on the car loan.

Listed below, we will take a look at several of the typical types of home loans. These home mortgages feature a fixed rates of interest and month-to-month settlement quantity, offering security and predictability for the customer. John decides to buy a house that sets you back $300,000 (california loan officer). He secures a 30-year fixed-rate mortgage with a 4% rate of interest rate.

What Does Kam Financial & Realty, Inc. Do?

This indicates that for the whole three decades, John will certainly make the same regular monthly payment, which uses him predictability and stability in his economic planning. These home mortgages start with a fixed rate of interest and payment quantity for an initial period, after which the rates of interest and payments may be occasionally readjusted based on market conditions.

The Kam Financial & Realty, Inc. PDFs

These mortgages have a fixed rates of interest and payment amount for the lending's duration however call for the consumer to settle the loan balance after a given period, as figured out by the loan provider. mortgage broker california. As an example, Tom has an interest in buying a $200,000 building. https://www.behance.net/luperector. He chooses for a 7-year balloon home loan with a 3.75% fixed rate of interest rate

For the entire 7-year term, Tom's regular monthly repayments will be based on this fixed rate of interest. However, after 7 years, the remaining car loan balance will come to be due. At that factor, Tom has to either repay the impressive balance in a round figure, re-finance the lending, or sell the property to cover the balloon settlement.

Falsely declaring self-employment or a raised setting within a business to misstate earnings for home mortgage functions.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.